Udyam (MSME) Verification API – Real-Time MSME Validation

Original price was: ₹45,000.00.₹30,000.00Current price is: ₹30,000.00.

Micro, Small, and Medium Enterprises (MSMEs) form the backbone of the Indian economy, contributing significantly to employment, innovation, and economic growth. To support this sector, the Government of India introduced the Udyam Registration system, enabling businesses to officially register as MSMEs and access various financial, regulatory, and operational benefits.

The Udyam (MSME) Verification API provides a secure, automated, and real-time solution to validate MSME registrations, fetch business category and size details, assess eligibility for government benefits, and streamline SME onboarding workflows.

Description

Udyam (MSME) registration verification is essential for organizations that work with micro, small, and medium enterprises across India. MSME status directly impacts government benefits, credit eligibility, procurement advantages, and regulatory compliance. Relying on self-declared MSME information increases the risk of misclassification and fraud.

Manual verification of Udyam certificates is time-consuming and difficult to scale for platforms onboarding large numbers of SMEs. Businesses need a real-time, automated Udyam verification solution to validate MSME registration details accurately.

The Udyam (MSME) Verification API provides a secure and real-time verification framework to validate MSME registration, fetch business category and enterprise size, support government benefit eligibility checks, and streamline SME onboarding workflows. This API is ideal for fintech, lenders, marketplaces, procurement platforms, and enterprise onboarding systems.

⚙️ How the Udyam (MSME) Verification API Works

The Udyam Verification API functions as a trusted MSME validation layer that confirms enterprise registration details directly from official Udyam records.

- 🏷️ MSME Registration Validation

- Validates the authenticity of the Udyam registration number.

- 🏢 Business Category & Size Details

- Fetches enterprise category (Micro, Small, Medium) and size classification.

- 🎯 Government Benefit Eligibility Support

- Helps determine eligibility for MSME-linked schemes, subsidies, and incentives.

- 🔁 SME Onboarding Workflows

- Integrates MSME verification directly into digital onboarding processes.

This workflow ensures accurate MSME classification, reduced onboarding risk, and seamless compliance with government programs.

🌟 Key Features & Benefits

- 🏷️ MSME registration validation

- 🏢 Business category & size details

- 🎯 Government benefit eligibility support

- 🔁 SME onboarding workflows

📊 Feature Comparison Table

| Aspect | Udyam (MSME) Verification API | Manual MSME Verification |

|---|---|---|

| Verification speed | ✅ Real-time | ❌ Manual & slow |

| MSME classification accuracy | ✅ Government-sourced | ❌ Error-prone |

| Benefit eligibility checks | ✅ Supported | ❌ Manual assessment |

| Scalability | ✅ High-volume API | ❌ Not scalable |

| System integration | ✅ API-based | ❌ Offline / document-based |

🚀 Business Benefits

- ⚡ Accelerate SME onboarding

- 📉 Reduce MSME misclassification risk

- 🎯 Enable accurate benefit eligibility checks

- 📄 Improve compliance & audit readiness

- 🤝 Build trust with verified MSMEs

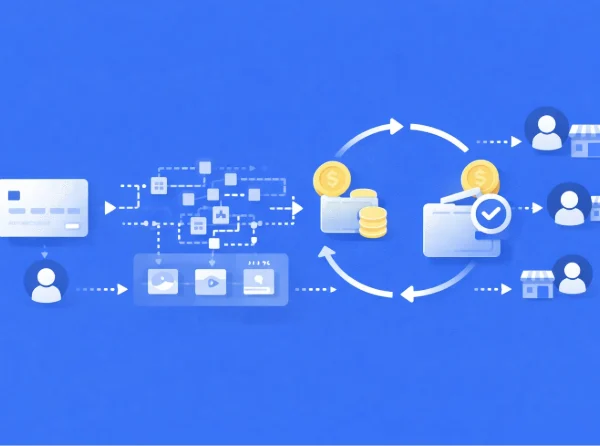

🏭 Use Cases & Industries

- 💳 Fintech & Lending Platforms

- MSME borrower verification and priority lending eligibility.

- 🛒 Marketplaces & B2B Platforms

- Seller MSME verification for procurement benefits.

- 🏢 Enterprises & Corporates

- Vendor onboarding and MSME compliance tracking.

- 🏛️ Government & PSU Programs

- Verification for MSME-linked schemes and incentives.

⭐ Why Choose This Udyam (MSME) Verification API

- 🏷️ Accurate MSME registration validation

- 🏢 Verified business category & size data

- 🎯 Government benefit eligibility support

- 🔒 Secure & encrypted API access

- ☁️ Built for scalable SME onboarding

❓ FAQs

What is a Udyam (MSME) Verification API?

A Udyam Verification API allows businesses to validate MSME registration and fetch official enterprise classification details in real time.

Does it identify Micro, Small, and Medium enterprises?

Yes. The API returns MSME category and size classification as per Udyam records.

Can it be used for lending and procurement?

Absolutely. It supports MSME eligibility checks for lending, subsidies, and procurement benefits.

Is the data secure?

Yes. All API communication is encrypted and handled using compliance-ready infrastructure.

Reviews

There are no reviews yet.