KYC Verification API – Secure Digital Onboarding

Original price was: ₹45,000.00.₹30,000.00Current price is: ₹30,000.00.

In today’s regulated digital economy, Know Your Customer (KYC) is no longer optional—it is a legal, operational, and trust requirement. Fintech companies, NBFCs, banks, marketplaces, SaaS platforms, and enterprises must verify user identities accurately while ensuring regulatory compliance, fraud prevention, and seamless onboarding.

Manual KYC processes are slow, expensive, and error-prone. Disconnected verification tools lead to poor user experience, high drop-off rates, and compliance risks.

The KYC Verification API solves these challenges by providing a fully automated, multi-document, compliance-ready KYC solution. It enables businesses to verify PAN, Aadhaar (where permitted), government IDs, and address details, run AML and risk checks, and maintain audit-ready compliance logs—all through a single, scalable API.

Description

Know Your Customer (KYC) verification is a mandatory requirement for financial services, fintech platforms, marketplaces, and regulated digital businesses. Manual KYC processes are slow, costly, and prone to errors, leading to onboarding delays, compliance risks, and poor user experience.

With evolving regulations and increasing fraud attempts, businesses need a centralized, automated, and compliant KYC solution that can verify multiple identity documents, assess risk, and maintain audit-ready records at scale.

The KYC Verification API delivers a robust, end-to-end digital KYC framework that supports PAN, Aadhaar, ID, and address verification, enables individual and business KYC workflows, integrates AML and risk scoring, automates onboarding journeys, and maintains compliance-grade audit logs. This API is ideal for fintech, banking, lending, SaaS, and enterprise platforms.

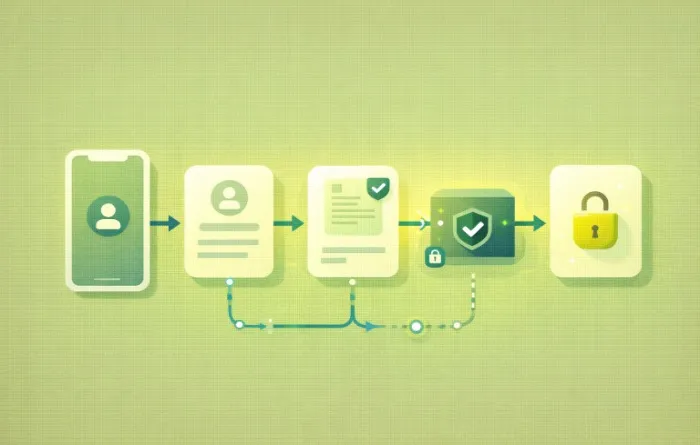

⚙️ How the KYC Verification API Works

The KYC Verification API acts as a unified identity and compliance layer that validates users while ensuring regulatory adherence and data security.

- 📑 Multi-Document KYC Verification

- Verify PAN, Aadhaar, government IDs, and address documents in a single workflow.

- 👤 Individual & Business KYC Workflows

- Supports both personal KYC and business/entity verification journeys.

- ⚖️ AML & Risk Scoring

- Assess customer risk using AML checks and configurable risk scoring models.

- 🤖 Digital Onboarding Automation

- Automate document collection, verification, and approval in real time.

- 🧾 Compliance Reporting & Audit Logs

- Maintain detailed verification logs for audits and regulatory reporting.

This workflow ensures faster onboarding, reduced fraud risk, regulatory compliance, and a seamless customer experience.

🌟 Key Features & Benefits

- 📑 Multi-document KYC verification

- 🆔 PAN, Aadhaar, ID & address validation

- 👤 Individual & business KYC workflows

- ⚖️ AML & risk scoring support

- 🤖 Digital onboarding automation

- 🧾 Compliance reporting & audit logs

📊 Feature Comparison Table

| Aspect | KYC Verification API | Manual / Fragmented KYC |

|---|---|---|

| Document verification | ✅ Multi-document, automated | ❌ Manual & fragmented |

| Onboarding speed | ✅ Real-time verification | ❌ Slow turnaround |

| AML & risk checks | ✅ Integrated risk scoring | ❌ Separate processes |

| Compliance readiness | ✅ Audit-ready logs | ❌ Poor traceability |

| Scalability | ✅ High-volume capable | ❌ Not scalable |

| System integration | ✅ API-based | ❌ Manual or offline |

🚀 Business Benefits

- ⚡ Accelerate customer onboarding

- 🛡️ Reduce identity fraud and risk

- 📉 Lower compliance and operational costs

- 📄 Maintain regulatory compliance

- 🤝 Improve customer trust & experience

- 🏗️ Scale KYC operations effortlessly

🏭 Use Cases & Industries

- 💳 Fintech, Banking & NBFCs

- Customer onboarding, account opening, lending workflows.

- 🛒 Marketplaces & Platforms

- Seller, vendor, and partner verification.

- 📦 SaaS & Enterprises

- Employee, partner, and customer compliance checks.

⭐ Why Choose This KYC Verification API

- 📑 All-in-one KYC verification platform

- ⚡ Fast, automated onboarding flows

- ⚖️ Built-in AML & risk scoring

- 🧾 Compliance-ready audit logs

- 🔒 Secure & encrypted data handling

- ☁️ Designed for scalable, regulated platforms

❓ FAQs

What is a KYC Verification API?

A KYC Verification API enables businesses to digitally verify customer identity using multiple documents while ensuring compliance and audit readiness.

Does it support both individual and business KYC?

Yes. The API supports individual, sole proprietor, and business/entity KYC workflows.

Is AML supported?

Yes. AML checks and configurable risk scoring are supported as part of the verification process.

Is the data secure?

Yes. All data is transmitted using encrypted channels and stored following strict security and compliance standards.

Reviews

There are no reviews yet.