Fraud Detection API – Real-Time Fraud Prevention

Original price was: ₹50,000.00.₹40,000.00Current price is: ₹40,000.00.

The Fraud Detection API is built to address these challenges by offering real-time transaction risk analysis, behavioral and pattern-based detection, device and IP fingerprinting, AI-powered and rule-based fraud logic, and alerts with reporting dashboards.

This API is ideal for payment gateways, fintech platforms, eCommerce businesses, banking systems, subscription platforms, and developer-built fraud monitoring solutions.

Description

As digital transactions continue to grow across payments, eCommerce, fintech, banking, and SaaS platforms, fraud risks are increasing at an alarming rate. Fraudsters continuously evolve their tactics—using stolen identities, bot-driven attacks, account takeovers, and abnormal transaction patterns to exploit system vulnerabilities.

A single fraudulent transaction can lead to financial loss, regulatory penalties, chargebacks, reputation damage, and loss of customer trust. Traditional static security checks are no longer enough. Businesses need real-time, intelligent fraud detection systems that can analyze transaction behavior, identify suspicious patterns, and respond instantly.

The Fraud Detection API is built to address these challenges by offering real-time transaction risk analysis, behavioral and pattern-based detection, device and IP fingerprinting, AI-powered and rule-based fraud logic, and alerts with reporting dashboards.

This API is ideal for payment gateways, fintech platforms, eCommerce businesses, banking systems, subscription platforms, and developer-built fraud monitoring solutions.

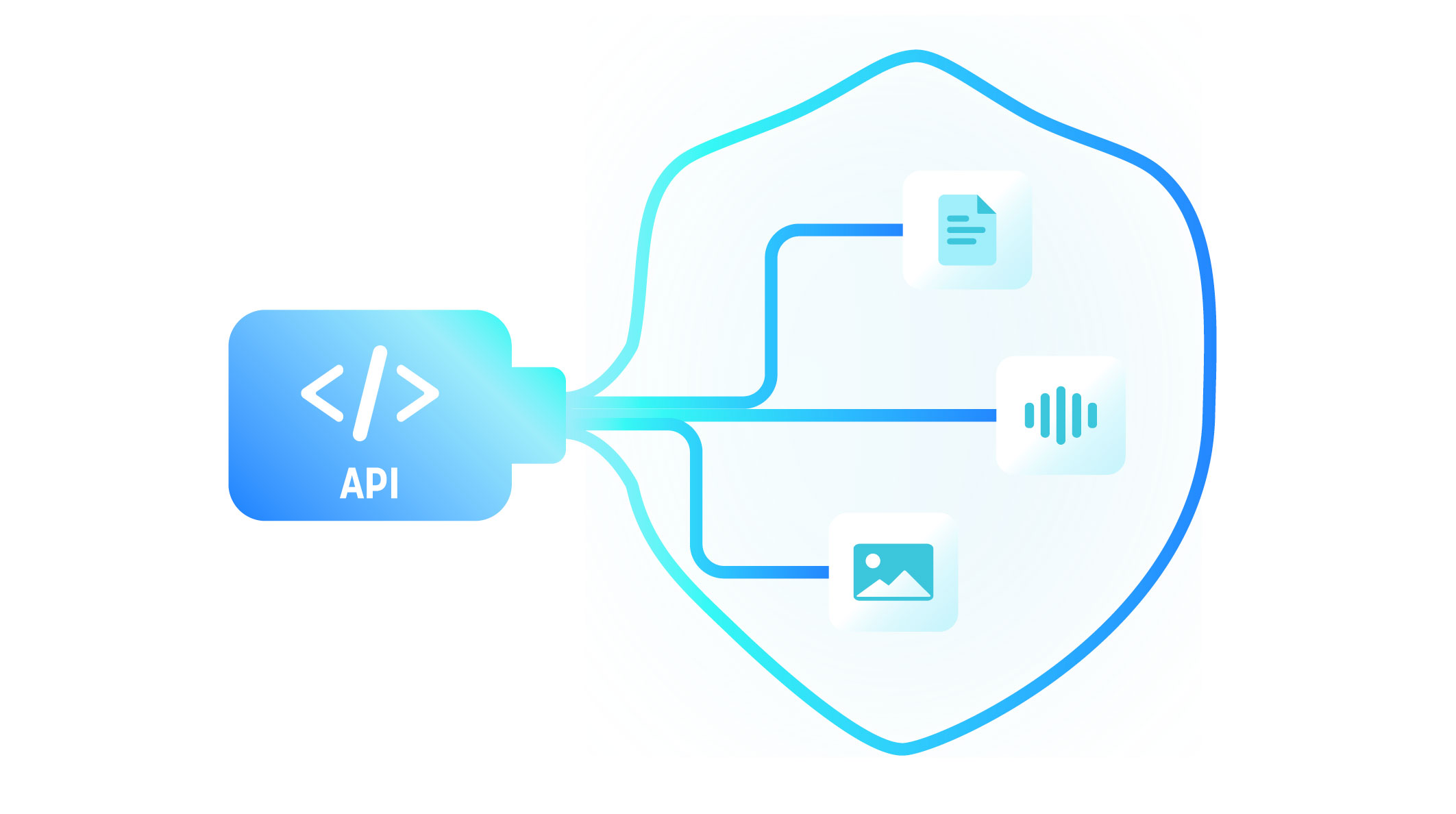

⚙️ How the Fraud Detection API Works

The Fraud Detection API functions as a high-speed, real-time fraud analysis and prevention engine, shielding your platform from financial loss and malicious activity.

- 🔍 Transaction Risk Analysis

- Every transaction undergoes an immediate evaluation of metadata, payment origin, and velocity to assess risk levels.

- 🧠 Behavioral & Pattern-Based Detection

- Advanced algorithms analyze user behavior and spending patterns to identify anomalies that deviate from established norms.

- 🌐 Device & IP Fingerprinting

- The API captures device IDs and IP signatures to detect proxy usage, VPN spoofing, and high-risk device histories.

- 📊 Real-Time Fraud Scoring

- A numeric fraud score is generated instantly, allowing your system to automatically approve, flag, or block transactions.

- 🤖 Rule-Based + AI Detection Logic

- The API combines customizable business rules with machine learning models to adapt to evolving fraud tactics.

- 🚨 Alerts & Reporting Dashboards

- Suspect events trigger immediate alerts and are visualized in a central dashboard for human review and audit trails.

This workflow ensures fast, intelligent, and actionable fraud detection, providing a robust security layer for modern digital commerce.

🌟 Key Features & Benefits

- 🛡️ Transaction risk analysis

- 🧠 Behavioral & pattern-based detection

- 🆔 Device & IP fingerprinting

- 📈 Real-time fraud scoring

- 🤖 Rule-based + AI detection logic

- 🚨 Alerts & reporting dashboards

The Fraud Detection API provides a multi-layered defense strategy, combining traditional business logic with advanced machine learning to identify and mitigate threats before they impact your bottom line.

🚀 Business Benefits

- 📉 Detect fraud before financial loss occurs

- 💸 Reduce chargebacks and transaction disputes

- 🛡️ Improve platform security and trust

- 📊 Analyze fraud trends and behaviors

- 🤖 Automate fraud monitoring processes

- ⚖️ Support compliance and audit requirements

By integrating this API, businesses can move from reactive damage control to proactive threat prevention, ensuring that legitimate transactions flow smoothly while malicious activity is stopped at the gate.

🏭 Use Cases & Industries

The Fraud Detection API provides a mission-critical security layer for digital businesses, ensuring that growth is not compromised by sophisticated cyber-threats:

- 💳 Payment Gateways & Fintech Platforms

- End-to-end transaction fraud prevention to maintain high merchant trust

- Real-time risk scoring to determine which payments require 3D Secure or MFA

- 🛒 E-commerce Platforms

- Checkout fraud detection to stop credit card testing and unauthorized purchases

- Device-based abuse prevention to block bots from hoarding limited-stock inventory

- 🏦 Banking & Financial Services

- Account takeover (ATO) detection by identifying unusual login locations and patterns

- Behavioral fraud monitoring to stop money laundering and unauthorized wire transfers

- 📱 Subscription & SaaS Platforms

- Abuse and signup fraud detection to prevent “trial gaming” and promo code misuse

- IP-based risk analysis to detect credential stuffing and VPN-masked account access

- 🧩 Developers & SaaS Providers

- Seamless fraud detection integrations for custom-built checkout flows

- Building custom fraud analytics systems using the API’s granular data points

🔍 Comparison: Fraud Detection API vs Manual Fraud Checks

| Aspect | Fraud Detection API | Manual Checks |

|---|---|---|

| Real-time detection | ✅ Yes (Milliseconds) | ❌ Delayed (Hours/Days) |

| Behavioral analysis | ✅ Supported (Continuous) | ❌ Limited (Static) |

| Device fingerprinting | ✅ Included | ❌ Not available |

| AI-based logic | ✅ Yes (Adaptive) | ❌ No (Rule-dependent) |

| Fraud scoring | ✅ Instant (0-100 Scale) | ❌ Manual (Subjective) |

| Alerts & dashboards | ✅ Built-in | ❌ Separate / Spreadsheets |

⭐ Why Choose This Fraud Detection API

- 🛡️ Real-time transaction risk analysis

- 🧠 Advanced behavioral and pattern detection

- 🆔 Device and IP fingerprinting support

- 🤖 AI and rule-based fraud logic

- 📈 Instant fraud scoring system

- 🚨 Alerts and reporting dashboards included

This API is built for platforms that require accurate, fast, and scalable fraud prevention to maintain financial integrity and user trust.

❓ FAQs

What is a Fraud Detection API?

A Fraud Detection API is a security integration that analyzes transaction data in real time using metadata, IP addresses, and user history to identify and block fraudulent activities before they cause financial loss.

Does it support AI-based fraud detection?

Yes. The API uses a hybrid approach, combining static business rules (e.g., “block transactions over $5,000 from high-risk countries”) with machine learning models that detect emerging fraud patterns automatically.

Are device and IP fingerprinting supported?

Yes. These are core features. The API identifies the specific hardware signature and IP reputation to detect if a user is using a VPN, proxy, or a device previously associated with malicious behavior.

Is fraud scoring generated in real time?

Yes. Every request receives an instant numerical score (typically 0-100). This allows your application to make split-second decisions to approve, flag for review, or block the transaction.

Are alerts and dashboards included?

Yes. The API includes a centralized reporting dashboard and real-time alert triggers (via webhooks or email) to notify your security team of high-risk incidents immediately.

Reviews

There are no reviews yet.