WhatsApp Loan Chatbot – Enquiry & Lead Management

Original price was: ₹140,000.00.₹100,000.00Current price is: ₹100,000.00.

WhatsApp Loan Enquiry Chatbot simplifies loan-related conversations by guiding users through initial eligibility enquiries, sharing required document checklists, and routing qualified leads to loan agents directly on WhatsApp.

It helps financial institutions respond faster, reduce manual enquiry handling, and improve lead qualification and conversion through a structured, automated chat-based experience.

Description

Loan providers and financial institutions receive a large number of enquiries related to loan eligibility, required documents, and next steps. Handling these enquiries manually often leads to slow responses, incomplete information sharing, and delayed follow-ups, which can reduce conversion rates.

To respond faster and qualify prospects efficiently, businesses need an automated solution that can guide users through initial loan enquiries, share required documentation details, and route qualified leads without manual effort.

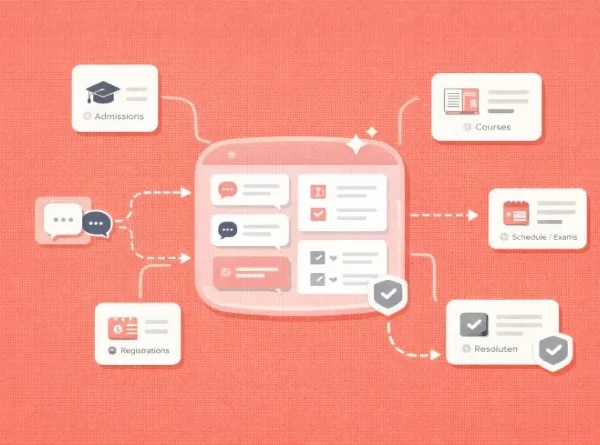

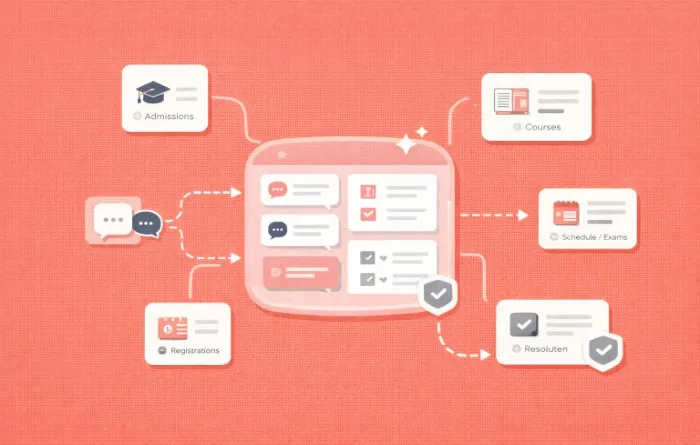

The WhatsApp Loan Enquiry Chatbot provides a structured automation layer for handling loan-related conversations on WhatsApp. It enables intelligent enquiry handling, structured information sharing, and smooth lead handover to loan agents.

This solution is ideal for banks, NBFCs, fintech platforms, loan agents, and financial service providers.

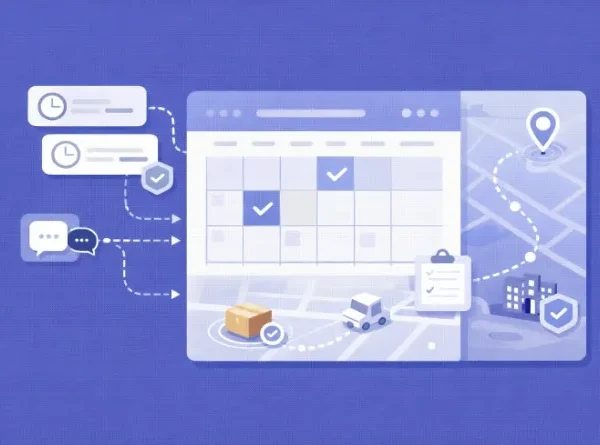

⚙️ How the Loan Enquiry Workflow Operates

The WhatsApp Loan Enquiry Chatbot follows a step-by-step process to qualify loan enquiries efficiently.

- 🧭 Conversation initiation

- Users start loan-related conversations on WhatsApp through ads, website buttons, or shared links.

- 🧠 Intent understanding & flow selection

- The system identifies loan enquiry intent and guides users through relevant questions.

- 📥 Preliminary information capture

- Basic user details and loan-related inputs are collected in a structured format.

- 📄 Requirement guidance

- Users receive clear guidance on required documents and next steps.

- 🔀 Lead handover & follow-up trigger

- Qualified enquiries are routed to the appropriate loan agent or sales team.

This workflow ensures faster enquiry handling, better lead qualification, and smoother loan consultation processes.

💎 Key Features

- 📊 Loan eligibility enquiries

- 📄 Document checklist sharing

- 🔀 Lead routing to agents

💼 Business Benefits

- ⚡ Respond instantly to loan enquiries

- 📄 Share accurate document requirements

- 🎯 Route qualified leads to agents faster

- 📉 Reduce manual enquiry handling effort

- 📈 Improve loan enquiry conversion rates

🏭 Use Cases & Industries

- 🏦 Banks & Financial Institutions

- Personal, home, and business loan enquiries

- Initial borrower qualification

- 💳 NBFCs & Fintech Platforms

- Digital loan enquiry handling

- Agent lead routing workflows

- 🧾 Loan Agents & Consultants

- Client enquiry management

- Document requirement guidance

🔍 Comparison: WhatsApp Loan Enquiry Chatbot vs Manual Enquiry Handling

| Aspect | WhatsApp Loan Enquiry Chatbot | Manual Handling |

|---|---|---|

| Response speed | ✅ Instant | ❌ Delayed |

| Information consistency | ✅ Standardized | ❌ Variable |

| Lead routing | ✅ Automated | ❌ Manual |

| Staff workload | ✅ Reduced | ❌ High |

| Lead qualification | ✅ Structured | ❌ Unstructured |

| Scalability | ✅ High | ❌ Limited |

⭐ Why Choose This WhatsApp Loan Enquiry Chatbot

- 🧭 Process-driven loan enquiry handling

- 📄 Clear document requirement guidance

- 🔀 Intelligent lead routing to agents

- 📈 Scalable financial enquiry automation

This solution provides a reliable foundation for automated, efficient, and conversion-focused loan enquiry management on WhatsApp.

❓ FAQs

What is a WhatsApp Loan Enquiry Chatbot?

It is a chatbot that automates loan-related enquiries and routes qualified leads to agents.

Can it help with loan eligibility questions?

Yes. The chatbot guides users through initial loan eligibility enquiries.

Does it share required documents?

Yes. Document checklist sharing is included.

Are leads routed to agents automatically?

Yes. Qualified leads are routed to agents or sales teams.

Who can use this chatbot?

Banks, NBFCs, fintech platforms, and loan service providers.

Reviews

There are no reviews yet.